cryptocurrency Forecast is as volatile as it is exciting. With new all-time highs, regulatory shifts, and surging institutional interest, many investors and analysts are asking: what’s next for crypto prices? This article dives into current forecasts, key driving factors, and plausible scenarios for Bitcoin cryptocurrency Forecast, Ethereum, and selected altcoins through 2025 and beyond.

cryptocurrency Forecasts Matter (—and Why They’re Hard)

Forecasting crypto prices is inherently speculative. Cryptocurrency markets are shaped by many factors:

Market sentiment & speculation

Regulatory changes globally

Institutional adoption (ETFs, corporate treasuries, etc.)

Technological developments, scalability, network health

Macro environment: interest rates, inflation, geopolitical risk

Because of these shifting levers, even the most well-founded forecasts come with wide confidence intervals. Models often use technical analysis, on-chain data, machine learning, or combinations thereof.

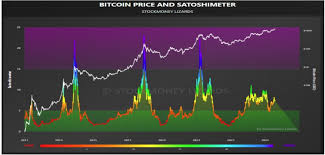

Bitcoin cryptocurrency Forecast Price Forecasts 2025–2030

Bitcoin remains the benchmark indicator for the broader market. Below are some prominent projections:

According to Finder’s panel, average year-end 2025 price is $145,167, with highs reaching ~$162,353 and lows around $87,618.

Some forecasts push even higher: Citi estimates Bitcoin could hit $135,000 in a base case by year-end, and in a bullish scenario, $199,000.

InvestingHaven suggests a 2025 trading band of $80,440 to $151,200, with stretch targets toward $175,000–$185,000.

Long term to 2030, some optimists see Bitcoin potentially passing $400,000–$500,000, assuming continued adoption and favorable regulation.

Scenario thinking for Bitcoin cryptocurrency Forecast

Base case: By late 2025, Bitcoin cryptocurrency Forecasttrades between $120,000 and $160,000, with periods of volatility

Bull case: Momentum from ETFs, corporate allocations, and favorable cryptocurrency policy push it toward $180,000–$200,000+

Bear case: Regulatory setbacks, macro stress, or market fatigue drag it back toward $70,000–$90,000

Ethereum cryptocurrency Forecast & Outlook

Ethereum is uniquely positioned thanks to its role in DeFi, NFTs, staking, and smart contracts. Some recent predictions:

Citi projects a year-end target of $4,300 for ETH.

Standard Chartered raised its forecast to $7,500 by end of 2025, citing strong adoption and ecosystem growth.

Technical signals suggest ETH could attempt a push toward $5,400+ in the near term.

Some speculative voices are even bullish toward $10,000+ in later years if Ethereum’s role continues to expand.

Ethereum Scenarios

Base case: ETH ends 2025 in the $4,000–$6,000 range

Bull case: With scaling solutions, new protocols, and institutional flow, ETH could challenge $8,000–$10,000

Bear case: If regulatory or network challenges emerge, ETH may correct toward $2,500–$3,500

Altcoins: Spotlight on XRP, Solana, Others cryptocurrency

While Bitcoin cryptocurrency and Ethereum dominate attention, some altcoins cryptocurrency Forecast are drawing bullish forecasts:

Solana (SOL): Standard Chartered expects SOL to reach $275 by the end of 2025 (and $500 by 2029).

XRP: Conservative forecasts put it near $2.05 in 2025. More aggressively, some see it climbing to $3.47 by 2025, and $10+ by 2030.

Because altcoins often carry greater idiosyncratic risk (technology, regulatory, adoption), their price forecasts tend to vary more wildly.

Key Factors & Risks That Will Shape the Outcome

Forecasts are only as useful as the assumptions behind them. Here are major levers:

- Regulation & policy

A favorable legal regime (e.g. clearer rules, ETF approvals) can boost confidence. Strict crackdowns or bans could reverse gains. - Institutional adoption

Continued inflows from hedge funds, pension funds, corporate treasuries, or sovereign wealth funds could provide sustained capital. - Technological advancement & scaling

Upgrades like Ethereum’s scaling, Layer-2 growth, wider interoperability, and efficient consensus mechanisms will matter. - Macro environment

Interest rates, inflation, global economic health, geopolitical stress—all will impact risk appetite and capital flows. - Market cycles & sentiment

Even in bull markets, corrections and “risk-off” periods are inevitable.

Takeaways: What Should Investors Expect?

Wide ranges are normal: Forecasts often span huge ranges due to uncertainty.

Use scenarios, not single numbers: Think “most likely,” “bull,” and “bear” cases rather than one fixed target.

Diversification is key: Even if Bitcoin or Ethereum surges, some altcoins or segments may underperform.

Stay updated: Policy changes, macro shifts, and tech updates can rapidly alter trajectories.

In conclusion, most credible forecasts for 2025 suggest a bullish year ahead for major cryptos, particularly Bitcoin and Ethereum, assuming supportive regulation and continued institutional interest. But that bullishness is far from guaranteed—headwinds remain. As always in crypto, vigilance, risk management, and flexibility are essential.